#21

bad boyfriends

This is a newsletter about regulatory hacking featuring (mostly) Canadian startups.

Every week, I contextualize a Canadian startup in the legislative landscape.

Because all start-ups need a policy strategy to succeed.

🔦spotlight: neo financial ⛷️slippery slope: City of Toronto re: Covid Alert Application Installation🛰️space: Amazon’s Head of Space Policy 📚legislative pages: Race After Technology 🪕tune: Necessary Evil🚨 spotlight: neo financial

Neo is a technology company offering a banking experience, brought to you from the team that brought you Skip the Dishes. They are offering a “smarter spending, saving and rewards experience for Canadians.”

From their website:

Neo is a Canadian tech company that does what banks do, and more. We’re reimagining spending, savings, and rewards from the ground up by using today’s technologies.

This means you can open an account within minutes on your phone, earn rewards from your favourite stores, and get real-time notifications when you spend and save, all without the monthly or annual fees. We’re set on helping you make the most out of your time and money.

The company promises that it is adding value to the banking experience (Big Five be like: banking is value-less?). A closer look confirms that Neo is engaged in both basic banking (high interest savings account + a credit card backed by Mastercard) and also marketing for small businesses that may want to reach a new audience. In that way, the firm is simultaneously serving two audiences that have - shall we say “divergent”? - interests.

On the one hand, it’s novel that Neo rewards potentially engaging smaller firms with less sophisticated or no rewards programs - that might be a smart way to support the little guy that lacks the data science or software to build a meaningful loyalty program. On the other hand: you are also encouraging people to….save money.

*Here is the rewards policy.

I wonder if it is a misnomer to call Neo a bank - they are working *with* banks - ATB Financial and Concentra bank, but they do something different. I suppose that Neo is really a platform of sorts - a marketing-like intermediary connecting you to reward options while also communicating with you about your savings. Granted, the app could discourage you from splurging if you haven’t hit a savings goal (I am imagining this, I don’t use the app).

Man, I didn’t MEAN to write about rewards again, I thought it was fintech time.

The wink of “rewards” are always red flag for me, as are “insights,” which is just code for summarizing (lots of) your data. We know that apps like these are and will be increasingly popular in and post-pandemic. Participating in marketing programs that allow you to engage in lite banking activity seems contradictory and foolish. Imagine your traditional bank pledging to your merchants that its “tech is fully automated to get customers to spend more at your business.” 🤡

I find this marvellous as in: I am marvelling at the disingenuousness.

PS. I know that the big 5 have rewards programs too, that tend to be points-based or involve cash back. They are pretty rudimentary, they persist, but that doesn’t mean they don’t have problematic aspects as well.

Other concepts similar to Neo Financial:

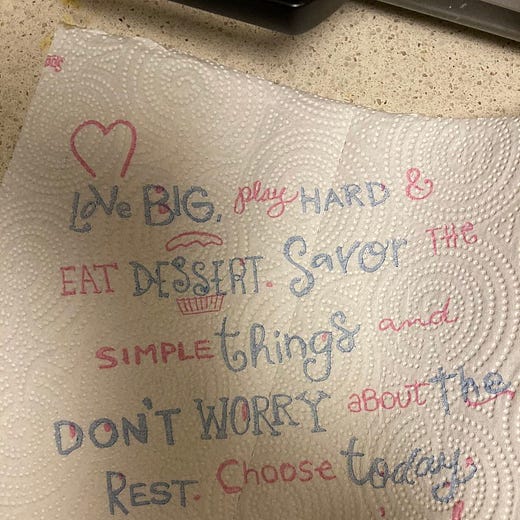

A food-tracking app that sends you to nearby pastry shops;

A fitness app that tells you when to tone it down;

Vaping as a way to smoke less cigarettes;

A sobriety app that also connects you to nearby LCBOs.

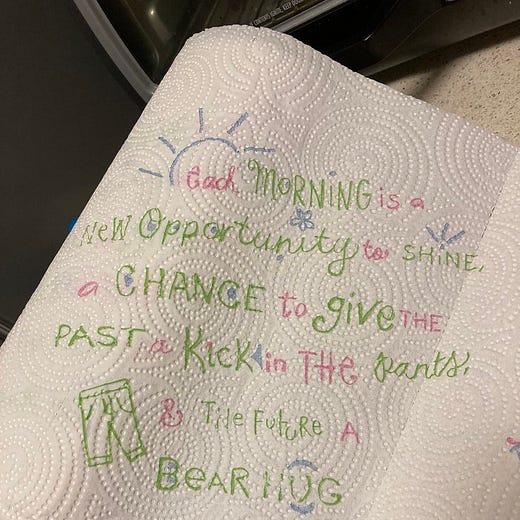

Basically: kind of like a bad boyfriend w/ a girl on the side or a gangster double-crossing you - just with super cute marketing!

🏢 regs

Given that Neo Financial seems to operate as a platform and in partnership with banks, their liability is low. I think they’d be classified as a rewards platform that bridges with banks. A lot of the “work” is left to the individual person - i.e. Neo doesn’t guarantee any of the rewards, etc. There is a lot of fine print.

💰riches

Yet another reminder that your banking data is très valuable and much sought-after in the sneakiest of ways. This is ostensibly how the firm might become profitable - through allowing small and medium-sized merchants access to different aggregated “profiles” of customers, etc. Previously I mused that this is kind of data capture/sharing an argument in favour of open banking. It may also be that firms like this want to guard their “advantage” and not have transactional information open up to everyone. I’d be curious whether Neo has a position on this.

I’m also curious whether this product appeals to YOU - let me know in the comments or shoot me a note. I love hearing from readers. 💌

🎿 slippery slope: city of Toronto employee phones

The City of Toronto will have a report back to Council on September 30th re: the “feasibility of installing the Covid Alert app on all City of Toronto managed mobile devices and the necessary steps to maximize the benefit of the software.” (h/t Matt Elliot’s newsletter City Hall Watcher).

Suddenly the ~voluntary~ contact tracing app isn’t looking quite so voluntary anymore. This is one to watch: a public employer toying with the prospect of installing a free mobile app on all of the phones that it pays for, ostensibly to help employees learn whether they’ve been exposed to COVID. Who could have seen this coming? 😡

I find this especially intriguing because most municipal employees are…working from home. 🏠

🐝 space: head of space policy

FYI: Amazon recently hired a former White House National Security Council member (Peter Marquez) to serve as its first-ever director of space policy. I creeped Peter on LinkedIn and noted he did his Masters in Space Policy at George Washington University. Courses below.

This role isn’t actually connected to Bezos’ “Blue Origin” program; rather, it’s part of Amazon Web Services (AWS). So the job is sort of focussed on…cloud computing.

How these private firms will shape the space [of space]. A book that touches on some of this is Space Barons.

📖 legislative pages: Race After Technology

I am tardy to the party that is reading Ruha Benjamin’s 2019 book, Race After Technology: Abolitionist Tools for the New Jim Code.

From everyday apps to complex algorithms, Ruha Benjamin cuts through tech-industry hype to understand how emerging technologies can reinforce White supremacy and deepen social inequity.

Benjamin argues that automation, far from being a sinister story of racist programmers scheming on the dark web, has the potential to hide, speed up, and deepen discrimination while appearing neutral and even benevolent when compared to the racism of a previous era. Presenting the concept of the “New Jim Code,” she shows how a range of discriminatory designs encode inequity by explicitly amplifying racial hierarchies; by ignoring but thereby replicating social divisions; or by aiming to fix racial bias but ultimately doing quite the opposite. Moreover, she makes a compelling case for race itself as a kind of technology, designed to stratify and sanctify social injustice in the architecture of everyday life.

One of the many provocations from the book that stuck with me, is “a parody project that beings by subverting the anti-Black logics embedded in new high-tech approaches to crime prevention,” the White-Collar Early Warning System.

🐦 Tweets about the book and related topics @NewJimCode.

tune: Unknown Mortal Orchestra - Necessary Evil

Lovin' me could be your fatal flaw

Just hangin in here trying to be your

Necessary evil, necessary evil