federal relief and the gig economy

Airbnb + Uber's new and unusual interest in a social safety net

This is a newsletter about regulatory hacking featuring (mostly) Canadian startups.

In the US, both Airbnb and Uber have called on the federal government to consider relief for the independent contractors on their platforms.

It is jarring to see both these companies so suddenly supportive of a social safety net for gig workers after aggressively resisting a traditional employment relationship with the “independent contractors” on their “platforms,” and probably pretty preformative overall. These are the same corporations that are essentially Irish entities for tax purposes, so shouldn’t they call on Ireland for help? Zing.

It also seems irresponsible to request federal help for…property managers?

*Full disclosure: I've done policy work with Airbnb in Canada in the past. What does Airbnb want?

The company is pushing for the legislature to allow property managers to get a tax credit for the money they make offering accommodations through its service and its competitors. Alternatively, it urged Congress to allow those hosts to defer the taxes on their short-term rental income.

Based on Twitter chatter, it seems that some subset of hosts would prefer to have their “future earnings” - which are projected based on their bookings - paid out to them. The Information covered the sense of inequity that hosts felt after guests on the platform were empowered to cancel their bookings and not incur any penalties.

In Canada, would Airbnb hosts be captured under the current relief regime?

Mortgage relief

Eligibility under the expanded EI coverage?

Mortgage relief

On March 17, the country's six largest banks – Bank of Montreal, CIBC, National Bank of Canada, Royal Bank, Scotiabank and TD Bank – announced immediate plans to allow a deferral of mortgage payments for up to six months. Interest rates will continue to accrue.

So, a short-term rental host that is concerned about their mortgage could apply for a deferral.

Expanded employment insurance

Would a short-term rental host be eligible for employment insurance (EI)?

If an STR host paid themself a salary with payroll deductions including EI premiums, then they would be eligible for EI Sickness benefits. If not, they might be able to apply for the new Emergency Care Benefit or Emergency Support Benefit.

FYI: Self-employed workers can opt-in to Employment Insurance special benefits including Sickness benefits. But you have to pay-in for 12 months before collecting benefits.

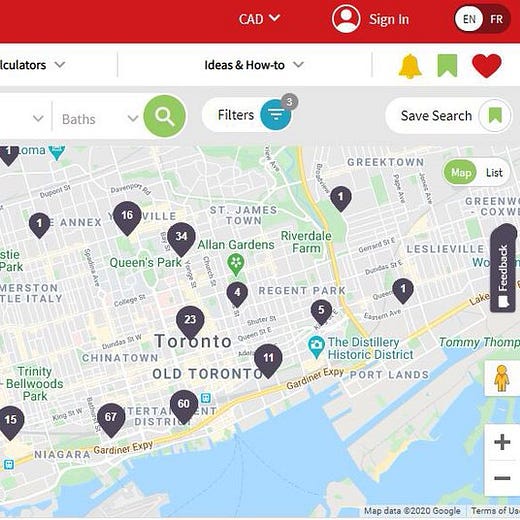

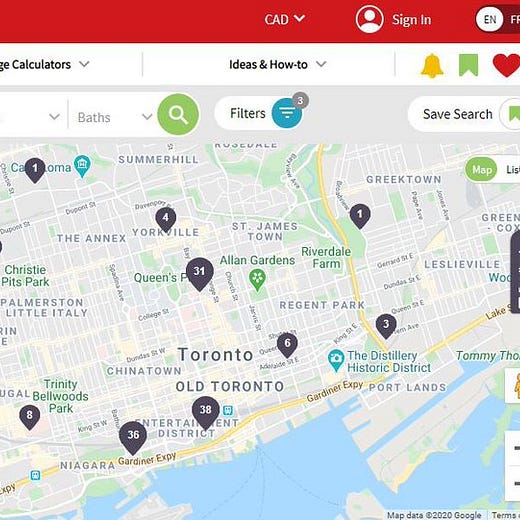

So, what’s happening with the properties?

Separately, a natural experiment of sorts is being observed on social media, whereby short-term rentals seem to be converted to long-term housing. The company is getting dunked on big time. A couple of examples below:

What does Uber want?

Uber Eats delivery workers truly feel “essential” during social isolation, and it’s a treat to order in - not to mention good for local restaurants that are trying to stay open.

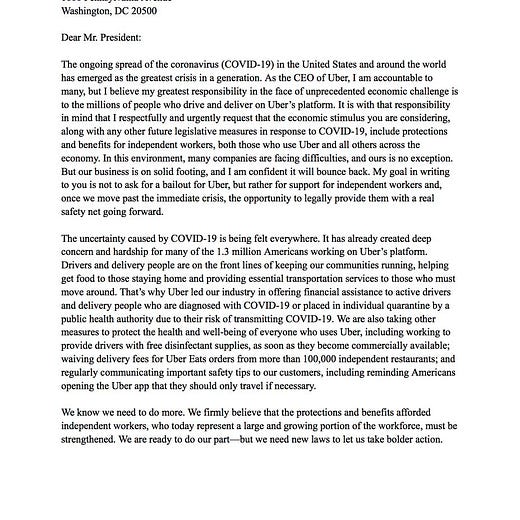

Here’s what UBER’s CEO had to say a couple of days ago:

Khosrowshahi in his Monday letter called on the federal government and state governors to update labor laws, establishing what he called a “third way” that would grant gig economy workers more protections and benefits without classifying them employees.

And some coverage in the Globe & Mail: Uber urges White House to include gig workers in coronavirus stimulus and yet the New York Times has reported that Drivers Say Uber and Lyft Are Blocking Unemployment Pay.

So - in what universe does a worker have benefits but they aren’t an employee?

Various US-states have been igniting this important debate, and we’ve been slower to engage in Canada.

California sparked a national debate about the rights of gig workers with a landmark law (it’s known as AB5, for “Assembly Bill 5 - Worker status: employees and independent contractors” and it extends employee classification status to gig workers) that required companies like Uber and DoorDash to treat their drivers as employees, entitled to certain benefits and protections, rather than contractors.

In Canada, 1.3 million people are self-employed, unincorporated and have no employees – the Statistics Canada definition of the “gig economy” (it includes freelance writers, babysitters and newspaper deliverers). The group represents 7 per cent of Canada’s 18.7 million workers, most of whom – 15.8 million, or 85 per cent – are considered employees.

Among the efforts in Canada to fight for gig-economy workers, Foodora delivery people voted this summer on unionizing and in February, the Ontario Labour Board ruled that Foodora couriers can form a union. Foodora argued its workers are not its employees and therefore cannot unionize.

This is a familiar argument that is being tested in the courts, legislatively, and in practice with calls like the ones Airbnb and Uber are making in light of COVID-19.

*If you’d like to read more about Uber’s approach to work, I highly recommend Alex Rosenblat’s “Uberland: How Algorithms are Rewriting the Rules of Work.”